Waiting for the Market to Crash is a Terrible Strategy

In my experience, investors sitting on a lot of cash are usually worried about equity valuations or the economy, and tell themselves and others that they're going to buy gobs of stock after a crash. The strategy sounds prudent and has commonsense appeal—everyone knows that one should be fearful when others are greedy, greedy when others are fearful. But historically waiting for the market to fall has been an abysmal strategy, far worse than buying and holding in both absolute and risk-adjusted terms.

Using monthly U.S. stock market total returns from mid-1926 to 2016-end (from the ever-useful French Data Library), I simulated variations of the strategy, changing both the drawdown thresholds before buying and the holding periods after a buy. For example, a simple version of the strategy is to wait for a 10% peak-to-trough loss before buying, then holding for at least 12 months or until the drawdown threshold is exceeded before returning to cash. This strategy would have put you in cash about 47% of the time, so if our switches were random, we’d expect to earn about half the market return with half the volatility.

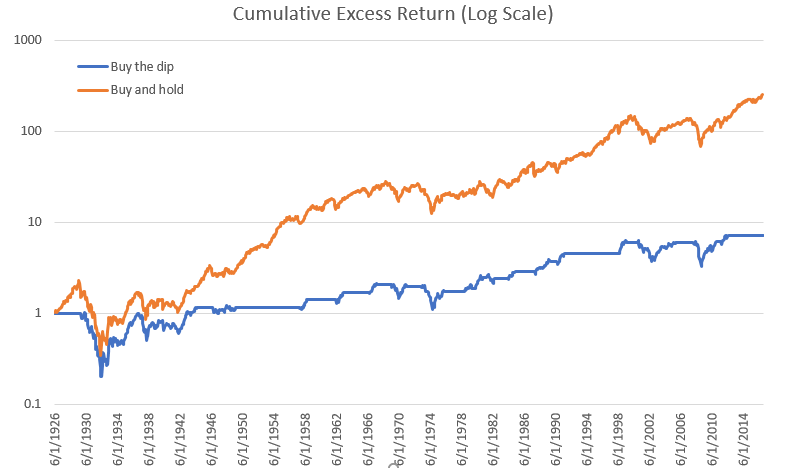

The chart below shows the cumulative excess return (that is, return above cash) of this variation of the strategy versus the market. Buy-the-dip returned 2.2% annualized with a 15.7% annualized standard deviation, while buy-and-hold returned 6.3% with an 18.6% standard deviation. Their respective Sharpe ratios, a measure of risk-adjusted return, are 0.14 and 0.34, meaning for each percentage point of volatility buy-the-dip yielded 0.14% in additional annualized return and buy-and-hold yielded 0.34%.

The above chart understates the terribleness of the strategy. In the chart below I plot the cumulative wealth ratio of the strategy over the market to show their relative performances. When the line is sloping down, dip-buying is underperforming; when it's sloping up, it's overperforming. As you can see, the line shows small jags of outperformance, expansive plateaus of neutral performance, and long rolling slopes of underperformance.

What about waiting for a deeper crash? For every drawdown level from -10% to -50% (in increments of 5%), waiting for a crash before buying results in lower absolute and risk-adjusted returns.

What about holding on longer? This helps, but not enough to make it a winning strategy. Here’s what holding for three years after a crash produces:

Holding for five years helps, too, but now we're getting closer to buy and hold:

None of the variations tested produces higher absolute or risk-adjusted returns than buy and hold.

The strategy fails for two reasons. First, the historical equity risk premium was high and decades could pass before a big-enough crash, making it very costly to sit in cash. Second, the market tended to exhibit momentum more than mean reversion over years-long horizons. As strange as it sounds, you would have been better off buying when the market was going up and selling when it was going down, using a trend-following rule.

The closest thing to a success is waiting for a 40% or 45% crash before buying, and then holding on for at least five years. That strategy would have captured more than half the market’s return while being exposed to the market only a third of the time. However, 40%+ crashes are rare, occurring only five times in our sample, or about once every 18 years. The best that can be said for our strategy is that medium-term returns after a big crash tended to be above average, so it's probably a good time to buy equities if you have cash sitting around and a multi-year horizon.

This data does not say you should always buy and hold, no matter what. It simply says that a mechanical strategy of waiting for a crash on average resulted in much worse absolute and risk-adjusted returns than buying and holding. It is conceivable that you could have some piece of information—say, market valuations or economic conditions or technicals—that indicates a big crash is more likely to occur. In fact, a drawdown from a prior peak is itself just such a piece of information, because bad returns tend to clump together.